who claims child on taxes with 50/50 custody

Who Claims a Child on Taxes With 5050 Custody. Solving your legal problems and putting your needs first are priorities for the Denver child custody lawyers at Littman Family Law and Mediation Services.

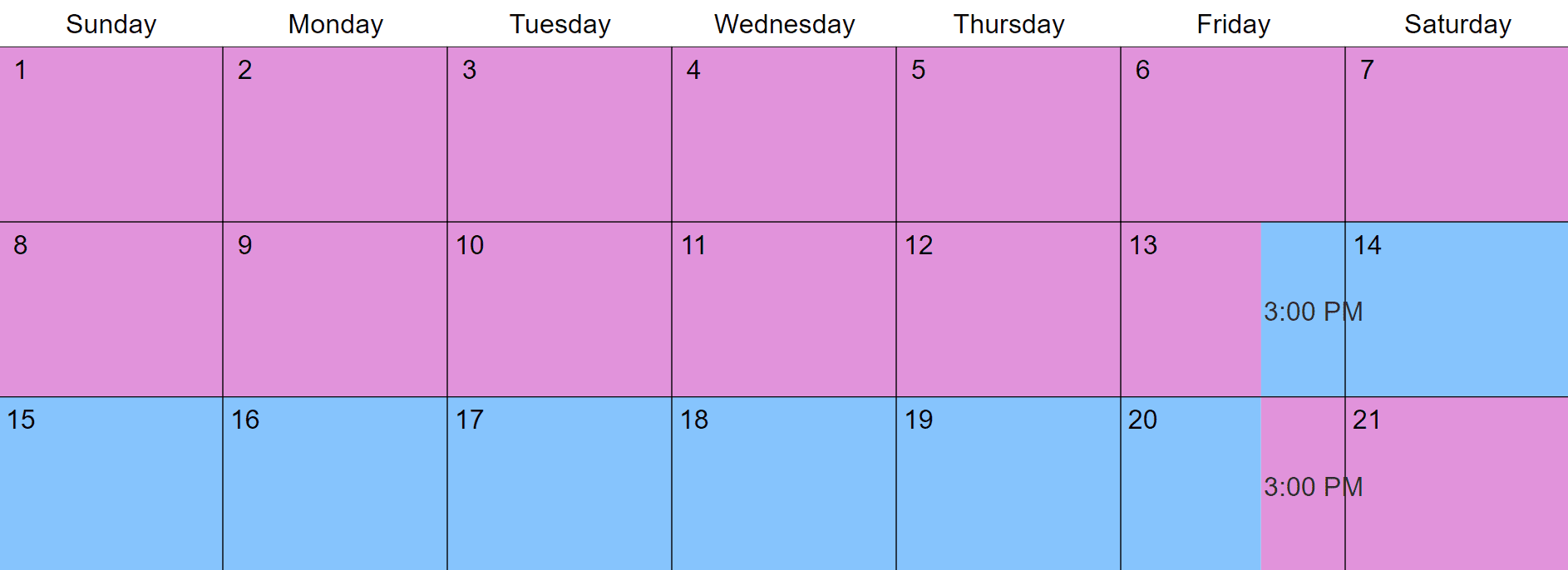

50 50 Joint Custody Schedules Sterling Law Offices S C

I provide more than 50 support and.

. Do You Claim Plasma Donation On Taxes. Tax law mentions custodial and noncustodial parents but does not mention joint physical custody or 5050 custody. Basically the custodial parent claims the dependent child for tax benefits.

The following arrangements were written into Joint Parenting Agreements during mediation prior to divorce and are from what I understand fairly boiler plate at least in IL. Yes it is allowed. However if the child custody agreement is 5050 the IRS allows the parent with the highest income to claim the dependent deduction.

My soon to be ex husband and I have decided to go for shared parenting with an exact 50 split of the time with our little daughter so there is no primary care give. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for children under age 6 and 3000 for other children under age 18. Ad Get Free Child Custody Lawyer Contacts and Legal Guidance Immediately.

Both of you could claim the child but not for the same tax benefit. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. In this way both parents if eligible have the opportunity to.

Call 303-832-4200 or contact us online for a confidential no-obligation consultation. In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns. Im divorced with one.

Our firm has more Super Lawyers than any other organization in the Lone Star State. As a custodial parent who spent the most time with the child during the year you will be entitled to claim Head of Household Earned Income Credit and. You who can claim a child ontaxes in a 5050 custody - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website.

The IRS developed a tiebreaker rule to help divorced. Generally IRS rules state that a child is the qualifying child of the custodial parent and. Top 10 Best Free Child Custody Lawyers Near You.

He is a high earner I receive child benefits child tax credits and working tax. But there is no option on tax forms for 5050 or joint custody. Im not a tax or legal pro so this is just my personal experience.

Certain credits and deductions may have slightly different rules The child must have any of the following relationships to you. In cases where custody is. The only exception to this is if the court says otherwise or if the custodial parent signs a form called the Release of Claim to Exemption for Child of Divorced or Separated Parents.

Who can claim child on taxes if the parents share 5050 joint legal custody. Whoever has custody for the greater part of the year as often stipulated in the divorce settlement typically gets to claim the child unless the court rules otherwise. Parents E-File to Get the Credits Deductions You Deserve.

Get an Expert Opinion2nd Opinion. When there is no signed document by the custodial parent then the IRS recognizes the custodial parents claim to dependency. You May Like.

Typically when parents share 5050 custody they alternate between odd and even years on which parent claims the child. Usually one parent has the children longer that the other especially since each year has 365 days except for last year---366. If there is more than one child the court may divide the children.

The custodial parent as defined by the IRS claims the child tax credit in a 5050 division. The credits scope has been expanded. However most parents state that they have joint custody or 5050 custody.

Ad Dont Take Chances w the Law. Asked on January 17 2013 under Family Law California. Contact an Experienced Attorney.

Children 17 years old and younger as opposed to 16 years old and younger will now be covered by the. June 4 2019 317 PM. Who Can Claim Children on Taxes in a 5050 Custody Order.

You must meet the following qualifications to claim a child on taxes. So one parent claims for the child one year and the other parent the next year. For a confidential consultation with an experienced child custody lawyer in Dallas contact Orsinger Nelson Downing Anderson LLP.

The credit amount has been increased. Answer 1 of 6. Child Tax Credits With 5050 Shared Custody.

Get Help from an Expert Right Away. If parents have 5050 parenting time but one parent contributes significantly more financials that parent may get to claim the child ren a greater percentage for example 2 out of 3 years. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them.

Heres what it does say. When claiming your child as dependents on tax returns make sure that the child meets the qualifying child requirements. If you and the other parent split possession time equally you can take advantage of the IRSs tiebreaker rule.

Ad Consult a Lawyer Specializing in Child Law. We strive to use our skills experience and resources to bring your case to the best resolution possible.

Who Claims Child On Taxes With 50 50 Custody Colorado Legal Group

Dear Parents What Your Child Really Needs This Christmas Dear Parents Parenting Apps Parenting Done Right

70 30 Custody Visitation Schedules Most Common Examples

Who Claims A Child On Taxes In A 50 50 Custody Arrangement

Do I Have To Pay Child Support If I Share 50 50 Custody Lawrina

Woman Refuses To Take 50 Percent Custody Of Her Kids From Her Ex Yourtango

50 50 Custody Child Support Calculator Family Lawyer Winnipeg

What Does A 50 50 Or Joint Custody Agreement Look Like

What Is Form 8332 Release Revocation Of Release Of Claim To Exemption For Child By Custodial Parent Turbotax Tax Tips Videos

Who Claims A Child On Us Taxes With 50 50 Custody

Do I Have To Pay Child Support If I Share 50 50 Custody

2 2 5 5 Visitation Schedule Examples How Does It Work

How Do You Claim A Child On Taxes With 50 50 Custody

How Do You Claim A Child On Taxes With 50 50 Custody

Who Claims A Child On Taxes With 50 50 Custody In California Her Lawyer

Does Joint Custody Mean Neither Parent Pays Child Support Renkin Law

50 50 Custody Are Courts Biased Against Men Graine Mediation

How Do You Claim A Child On Taxes With 50 50 Custody

How Long Do You Have To Pay Child Support Nussbaum Family Law